Rural News

Monthly Mindset: Four Decisions that Drive Growth

Growth is the ultimate goal for any business, but achieving it requires intentional planning and execution. This month’s mindset focus at Rural Chartered Accountants is all about The Four Decisions for Driving Growth, presented by our Client Services Administrator, Shona.

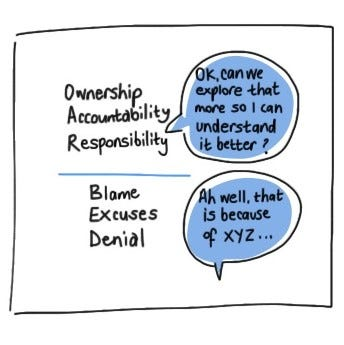

Understanding the OARBED Behaviour Model

Running a business in a rural community comes with its own unique challenges and opportunities. Whether you’re managing a farm, a local retail store, or a growing service business, success often depends on how you and your team approach problems and take ownership of outcomes.

Applications Open for Rabobank’s 2025 Business Management Programmes

Rabobank’s Business Management Programmes – the Farm Managers Programme (FMP) and the Executive Development Programme (EDP) – are now accepting applications for the 2025 intake!

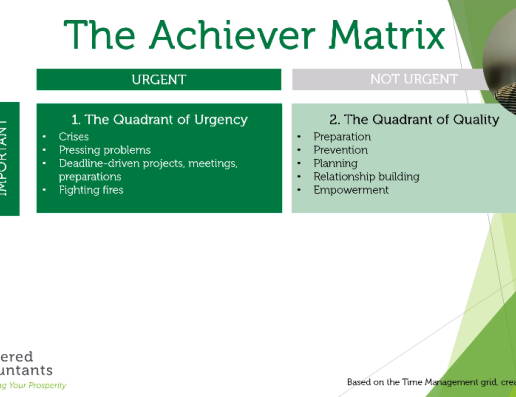

Monthly Mindset: The Achiever Matrix

Time is our most valuable resource, yet so many of us find ourselves constantly busy without feeling truly productive. The Achiever Matrix is a time management mindset that helps us rethink how we spend our time and where we should focus our energy.

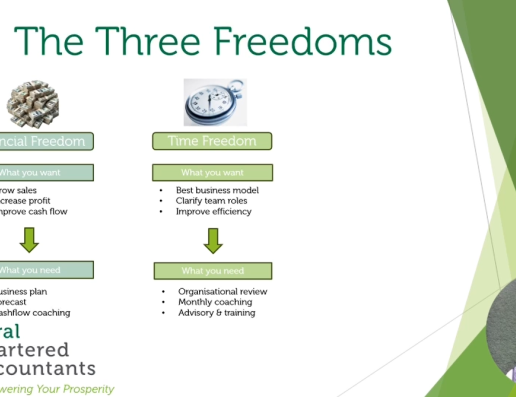

Discover the Three Freedoms every business owner needs to thrive!

Running a successful business isn’t just about making profits—it’s about achieving the right balance in your financial, time, and mental well-being. In this blog post, Carlene walks us through how Financial, Time, and Mind Freedom can transform your business and life, and shares practical steps to…

Reflections from Seeing David Goggins Live

This event was a great reminder to be intentional with our time. After all, we can’t make more of it. What would you do with an “extra” 22 hours a week? What would Goggins do (WWGD)? I imagine he would fit in another run or a few thousand pull ups.

Planning for Success

Embarking on life's journey without any goals is like setting off into the unknown without a map. How many of us would start any journey without a clear destination in mind?

SMART Goal Setting

In this latest Monthly Mindset, Emma gives a quick summary of how to set SMART goals and why these are important for achieving success in your business.

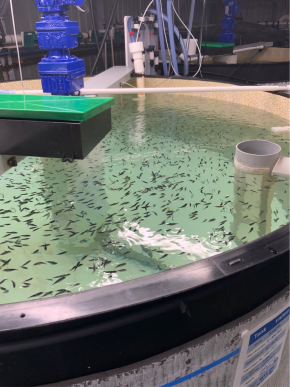

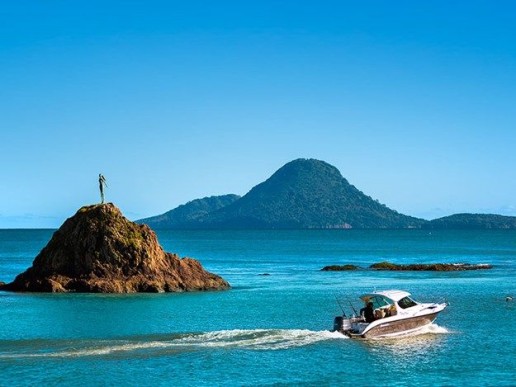

Exploring the Future of Aquaculture

During her Nuffield scholarship travels around New Zealand, Shannon Harnett, a Partner at Rural Chartered Accountants, had the opportunity to visit the groundbreaking Kingfish farming facility in Ruakākā. This state-of-the-art, land-based aquaculture farm has captured attention not only for its…

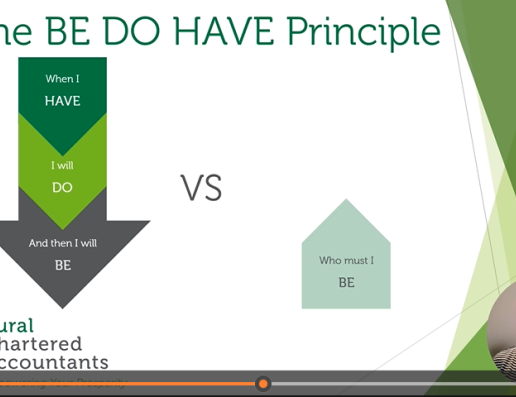

Monthly Mindset: The BE, DO, HAVE Principle

The BE, DO, HAVE Principle is a useful mindset about how we prioritise our time to achieve our goals. RuralCA Partner, Juanita Mottram, presents this month's Monthly Mindset here...

New Partner and Business Relaunch

Rural Chartered Accountants, a leading financial services firm based in Whakatane, is thrilled to announce the appointment of Juanita Mottram as a Partner. The official announcement coincides with the relaunch of the business under its new name, Rural Chartered Accountants (formerly Rural…

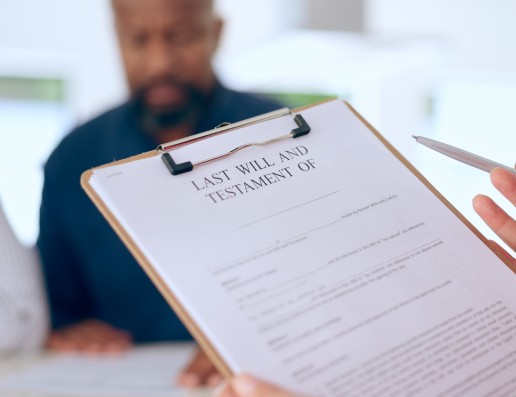

It's Wills Month

September is Wills Month which is a timely reminder for farmers to make sure your will is current and deals with your assets as you would have wished.

Protect Your Business with AuditShield

As a business owner, you've got enough on your plate without worrying about unexpected expenses, especially when it comes to something as daunting as a tax review or audit by the Inland Revenue Department (IRD).

Cash Flow Forecasting for a Tough Economy

In an increasingly unpredictable economic landscape, businesses of all sizes face a multitude of challenges. From fluctuating market demands to rising costs, the ability to maintain financial stability is more critical than ever.

Addressing Rural Health Disparities

Health outcomes in rural areas are falling behind those in urban centres on nearly every metric, according to academics from Waikato and Otago.

Unclaimed Money at the IRD: Your Guide to Reclaiming Forgotten Funds

Discovering unclaimed money can feel like striking gold. In New Zealand, the Inland Revenue Department (IRD) safeguards unclaimed funds, offering a valuable resource for those who may have forgotten about their assets.

Understanding New Zealand's Bright-Line Test for Residential Land

The bright-line test, introduced on 1 October 2015, applies to residential land transactions, ensuring that gains from property sales are taxed if the property is sold within a specified timeframe. There are exclusions for farmland, business premises, and the main home.

New Zealand Announces Tax Relief Measures in 2024 Budget

Who doesn’t love a bit more of their earnings in their pocket? The New Zealand government has recently announced tax relief measures in the 2024 budget, aimed at providing financial relief to households and individuals.

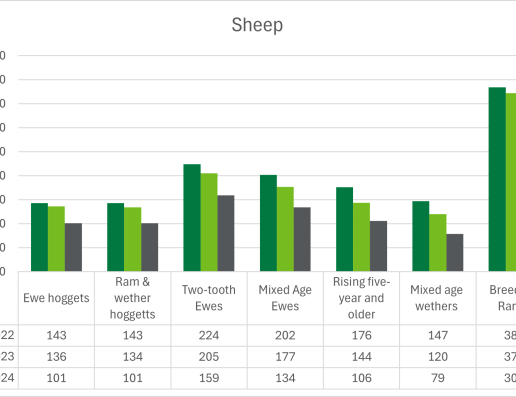

2024 Herd Value - Comparatives

The graphs below reflect how, over the past three years, the national average market values (NAMV) of livestock under the herd scheme have experienced noticeable fluctuations.

Mortgage Tax Deductions Restored

Landlords will once again be able to claim tax deductions for interest on residential investment property from the start of next month, David Seymour says.

Understanding the Implications of the Trustee Tax Rate Increase

On April 1st, New Zealand is set to implement a significant change in its tax policy that will affect trustees and beneficiaries alike. The trustee tax rate is slated to increase from its current level to 39%.

90 Day Trial Period Rules

New Zealand farmers hiring farm workers must adhere to specific regulations regarding trial periods for new employees.

Fonterra Raises Forecast Amid Supply and Demand Shifts

New Zealand's dairy giant, Fonterra, has recently made significant adjustments to its farmgate milk price forecast for the 2023/24 season, reflecting changes in supply and demand dynamics.

We’re Now eSigning with Annature

Now that we’ve established that our clients are comfortable using eSignature verification platforms, we’ve selected Australian-made and owned, Annature, as our preferred provider.

Worksafe And ACC - Concerns Over Farm Safety

Worksafe reporting show concerning trends in on-farm safety risks when comparing farm related injuries to other injury claims.

Debt and Risk Management for Farmers

Profits are down and expenses are rising, Federated Farmers reports, and the banks are suggesting farmers consider tightening their belts.

Dairy NZ Econ Tracker

Dairy NZ has released a new tool called the Dairy NZ Econ Tracker, it can be used to compare and forecast farm costs.

The Farmlander - Shannon's Interview

Director Shannon Harnett recently featured in the Farmlander in an interview about her Nuffield scholarship research.

Getting Plant Varieties Right

In November 2019, Rural Accountants Director Shannon Harnett was 1 of 5 awarded a prestigious Nuffield Farming Scholarship for 2020. A highly sought-after New Zealand primary industry scholarship, a Nuffield is a global scholarship with results that feed back to the NZ agri-horticulture sector.…

Income Equalisation for Flood Relief

IRD has implemented changes to their income equalisation scheme that will support farmers and orchardists in flood-affected regions.

Minimum Wage Increase 2023

The mimimum wage is set to increase on the 1st of April. Rural Accountants can assist you with any of your payroll needs.

Food Industry Update

The food industry in New Zealand is changing rapidly, with rising costs and ongoing challenges. Rural Accountants has put together a brief summary of some recent news articles related to the industry that may be of interest.

Emissions Requirements Continue to Evolve

Discussions around requirements for farmers to account for their emissions are ongoing, with prices and rules continuing to evolve and be subject to review.

Nil Filings and GST Registration

This year, IRD sent out letters to people who were registered for GST but filed nil returns for over 4 years advising them that they would be de-registered for GST. Rural Accountants is keeping an eye on the developing situation for nil-filing clients.

Migrant Worker Protections

The government has made some changes to protect migrant workers. Rural Accountants keeps up to date with these changes to advise employers as they hire workers from overseas.

Advances in AI A Hopeful Glimpse of the Future

There are many challenges facing farmers and businesses these days and the potential to integrate emerging technology, particularly AI, into daily business practices offers an exciting glimpse of the future of problem solving. AI may help ease the burden of processing massive data sets, and most…

Changes to Trust Reporting Requirements

There have been changes to the requirements for reporting on Trust Tax Returns. Rural Accountants explains some of these changes and how it may affect you.

Uncertain Future for Carbon Capturing

The future of carbon capturing rules are uncertain as two Ministers have changed their stance on which trees, or forests, should be included in the Emissions Trading Scheme.

Cost of Living Payment 2022

The Government has introduced a cost of living subsidy payment for 2022, but who qualifies, and what do you need to do to access it?

Being in Control of Your Household Spending

Rural Accountants would like to share some basic and important steps often missed when creating a household budget.

He Waka Eke Noa

On the 8th of June He Waka Eke Noa (HWEN) recommendations were released to government. The partnership between government, Iwi and Industry recommends an alternative to agricultural emissions being included in the NZ Emissions Trading Scheme, NZ ETS. Accountants are expected to be heavily involved…

Rural Accountants Know Horticulture

Christine and Shannon, our managing directors are actively involved in the horticulture industry in Hawkes Bay, Northland and Bay of Plenty.

Fonterra Expands Seaweed Trials for Methane Reduction

Over the past two years 900 dairy cows on a Tasmanian farm have been fed small amounts of Asparagopsis seaweed to examine its methane reduction potential in grass-fed farming. The results have been promising at each stage and trials are now expanding.

Emissions Reduction Plan Funds Big Changes for Agriculture

On the 16th May the government released its controversial and action-orientated Emission Reduction Plan, ERP. It has been considered generous by many that the agricultural sector has been awarded $710 million from the plan.

Government Consultation on Managing Exotic Afforestation

Last month Rural Accountants published a news piece Carbon Credit Controversy highlighting the concerns to the NZ rural sector of forestry in the ETS.

Public Holiday Pay: Know Your Rights and Obligations

With Easter this weekend, followed closely by Anzac Day, we thought it timely to remind everyone of the rules for public holiday pay...

Trust Law Shake-Up

The Labour Government has introduced a new top tax rate of 39% for income earned over $180,000 for the 2022 financial year. This has coincided with a major shake-up by IRD to ensure trusts can’t be used for tax avoidance purposes.

Financial Support Packages for Covid Affected Businesses

As you may well be aware of, the Government has recently released details of the new financial support for business affected by Covid. Following are a few details outlining the new packages...

Inflation - Double-Edged Sword for Farmers

A record payout for milksolids of $9.10 per Kilogram for the 2021-22 season may be worth celebrating a,s for many dairy farmers, it may simply provide a bit of extra breathing room.

Carbon Credit Controversy

The topic is hugely emotive for many Kiwis as it has resulted in a dramatic change to what has historically and quintessentially been viewed as the backbone of the rural Kiwi community landscape.

Christmas Holidays & Leave - Tips for Employers

From annual leave to public holidays (like Christmas) your worker(s) must get at least the legal minimum. Of course, there are different rules for different types of leave so understanding your obligations as an employer makes it easier to work out leave entitlements and approve leave – leading to…

Fortnightly Resurgence Payments

The Minister of Finance has announced the Government will increase the amount and frequency of the Resurgence Support Payment. They will be available fortnightly, on 12 November, until Auckland moves into the new Covid Protection Framework.

Purchase Price Allocation - A Quick Update

If you are thinking of buying or selling farm land, it is extremely important that you talk to us prior to signing the Agreement for Sale & Purchase.

The IRD has introduced new Purchase Price Allocation (PPA) legislation which came into effect for sales and purchases after 1 July 2021. This could…

Juanita Promoted to Associate

As we approach the end of another very busy and challenging year for our team here at Rural Accountants, we are pleased to share some good news. Juanita Motram has recently accepted her promotion as Associate seeing her get one step closer on her career path to make Partner one day.

Welcome Back Emma

We are pleased to welcome back a friendly face to the team. Emma Banbury has returned from studying in Wellington to take on our Administrator role here at Rural Accountants in Whakatane.

A Quick Update on Accounting Updates

There has been lots of change in the accounting world over the past while, mostly due to the government changes to help businesses with the effects of Covid. Following is a short summary of the changes that have taken place so far this year. If you have any concerns, please contact us to discuss.

Shannon's Nuffield Scholarship Report - Innovation in the Primary Sector

Rural Accountants director, Shannon Harnett, and co-writer, Ben Mclauchlan, delivered this report on Innovation in the Primary Sector for their NZ Nuffield Farming Scholarship. Shannon and Ben identified four innovation mindset personas – defined by risk appetite and the ability to pivot towards…

Herd Scheme

For any farmers who still have their livestock valued at the National Standard Cost Scheme (NSC) 2021 could be an opportune time to consider whether they should look at changing over to the Herd Scheme (National Average Market Values). The downside to moving is that it brings forward the tax cost on…

Business Expenses - What You Can't Claim

In this latest blog post, we try to create some clarity around expenses you can claim versus expenses you can’t claim in your business accounts. Ask us about Xero training to help you stay ahead of your accounts.

Cash Is King!

Our clients often ask us for help with managing their cashflow. A statement of cashflow is one of the three key financial statements that tracks all the money flowing in and out of your business

Sharemilking – Some Essential Accounting Tips

As our region’s leading rural business accounting firm, we work frequently with sharemilkers as well as farm owners. Ensuring you are managing your income and expenses properly is just as important as a self-employed person so here’s some essential tips to keep you on the path to success.

Dairy Training: Business by the Numbers

Get practical techniques and confidence to manage the numbers in an agribusiness.

Do you want to upskill your business knowledge at a course supported by Rural Accountants? Build a positive and profitable financial plan for going forward? Learn alongside other farmers and from farmers (Dairy…

End of the Financial Year

It is that time of year again, where accountants are starting to prepare for the new financial year, for most of you this is the 31st March, if you are in the Rural industries this could also be 31st May or 30th June, but the same principles apply.

Minimum Sick Leave Entitlement Proposed to Increase from 2021

The Government has introduced the Holidays (Increasing Sick Leave) Amendment Bill to increase the minimum employee sick leave entitlement from 5 days per year to 10 days per year.

New 39% Personal Tax Rate

The new 39% personal tax rate on income above $180,000 has now been finalised and will apply from 1 April next year (the 2021-22 income year).

Christmas Holidays & Staff Leave

With Christmas fast approaching, we thought it timely to share some of our tips and advice for managing this holiday period and staff leave requests to help with your accounting, payroll and tax obligations.

Why Farm Succession Planning is Important

Succession seems to be at the forefront for a lot of farming families at the moment and for many, it just seems too hard. There are very good reasons why it has become far more difficult than it ever was in the past.

Our Team Agriculture & Horticulture Field Trip

It was a big afternoon out for 12 of our team from Rural Accountants who took part in an agriculture and horticulture field trip organised by managing director, Shannon Harnett, who is also personally involved in all of the farms and farming projects we visited.

Preparing for Changes to the Trusts Act

Many clients who have Trusts will be aware that this Act comes into force in January 2021. We are currently ensuring all the records are up to date for any Trust where Whakatane Trustee Services Ltd (which is Rural Accountant’s Trustee Company) is an independent trustee.

Government reveals 10-year plan to boost primary sector by $44b

The Government plans to increase primary sector export earnings by $44 billion over the next decade with a goal of getting 10,000 more New Zealanders working in the sector over the next four years.

Coaching Our Clients on Xero Basics

With so many of our clients now transferring to Xero, we want to ensure everyone is getting the most out of their subscription and able to manage their accounts confidently on this fantastic cloud-based software.

Paying Your Taxes by Cash or EFTPOS at Westpac

When you make tax payments at a Westpac branch or Smart ATM, you will now need to have a barcode to ensure the payment goes to the right place. Barcodes are usually printed on Inland Revenue returns, statements or letters. You can also create a barcode on the IRD website for printing or presenting…

A Seamless Transition to Working Remotely

Like most businesses in New Zealand, shifting to remote business operations was not without its stresses and challenges. However, we have all been quietly impressed with how seamless the change has been for our team at Rural Accountants.

How to run your payroll using the wage subsidy

As is the current situation across the board, the wage subsidy guidelines are also a bit of a moving feast. Some employers are concerned about the potential implications of making a mistake with their application, particularly if you have based the application on a forecast position. Here are a few…

Hubdoc Addition Takes Xero Document Filing to the Next Level

As from 18th March 2020, Hubdoc, Xero's data capture tool, will be included in all Xero Starter, Standard or Premium plans. This upgrade to the already incredibly efficient and easy-to-use online accounting software platform will be a real game-changer for many people saving even more time and…

Washing Hands a Top Priority - Supporting Our Team with Covid-19

We are taking a cautious yet considered approach to how we deal with the threat of Covid-19 or Corona Virus here at Rural Accountants. Our aim is to maintain open communications sot hat everyone understands the precautions they can take. As part of this process, we have circulated an email of…

Stay Alert to Scammers

Recently there's an increase in scammers pretending to be from well-known phone companies or banks.

Reconciling Livestock Tallies

One of the challenges in preparing a set of farming financial statements is the completion of the livestock reconciliation.

New Rules On Ring Fencing Losses

From the 2019-20, and later income years, new ring-fencing rules apply to residential property deductions.

NZ Manuka Honey Super Hot At Harrods!

New Zealand's True Honey Company's Rare Harvest Mānuka Honey hit the shelves at Harrods a few weeks ago and is proving to be very popular.

Shannon Harnett Awarded 2020 Nuffield Scholarship

Rural Accountants director Shannon Harnett awarded 2020 Nuffield Scholarship.

Cracker Kiwifruit Payout Forecast

Zespri's October forecast for 2019/20 great news with increases across all four main varieties.

Rural Accountants Celebrates 100 Years!

Local accounting firm Rural Accountants celebrates its 100th birthday on October 1st this year.

Changes Coming to Trust Law

The new Trusts Bill, expected to become into law in late 2019, will have major implications for trustees.

These Are 'Interest-ing' Time We Are In

In a surprise move last week, NZ's Official Cash Rate was slashed to reflate a flagging economy.

Why We Love Xero!

Why Do Rural Accountants love Xero? Simply because it is the easiest way to run your business or accounts.

Anti-Money Laundering & Countering The Financing Of Terrorism; Why It Matters

Have you noticed that when you go to a bank, deal with a real estate agent or your lawyer, you get asked to produce a range of ID where previously this was not required - what is this all about?

Historic Local Firm Passes the Mantel

On 1st June 2018, one of our long-standing historic businesses, Prideaux & Co, officially passed the mantel to relative new-comer to Whakatane, Rural Accountants Limited Partnership.

Our New Normal at Level 2

Now that we are in Level 2, we wanted to share with you what this looks like for us at Rural Accountants and the safety procedures we have in place to keep our team and community safe through this next stage of the Covid-19 pandemic.

Studies Continue for Shannon and Other Nuffield Scholars

When Covid-19 hit, around 75 Nuffield scholars from around the world including our very own director Shannon Harnett, were on Moreton Island, 40km off the coast of Brisbane, for a conference that would kick-start an exciting year of travel and agriculture research.

DocuSign – Our Trusted Agreements System

With the recent events of this year, we realised that one of our biggest challenges was in getting financial documents and agreements completed and signed to legally accepted levels. Not being able to physically hand over documents or arrange signatures remotely became a bit of a headache for us…

ACC Announces Changes to Support Business Owners

As business owners focus more on cash flow management and finding ways to get through this challenging period, ACC has now come to the party announcing changes to support businesses...